2024 will be transformative year for the world of electronic securities and tokenized assets. This outlook offers a sneak peek into what lies ahead: a surge in issuances under the German Electronic Securities Act (eWpG) and a fast-growing and dynamic tokenization market for real world assets (RWA). From past trends to future projections, this overview paints a comprehensive picture of what to expect in the industry in 2024:

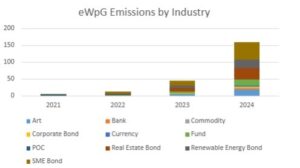

The landscape of electronic securities under the eWpG continues to evolve, showcasing remarkable growth, resilience and adaptability. Over the past years, the number of issuances of electronic securities has been on the rise, albeit growth hasn’t been explosive. 2021 began with 4 issuances, setting the baseline. Subsequently, in 2022 and 2023 with 13 and 45 issuances respectively, this growth accelerated, marking an upward trajectory in issuances by sector, indicating the widening acceptance and utilization of electronic securities in the German-speaking world.

Due to this positive trend we expect other German security token offerings (STOs), especially those not regulated under the eWpG, to be crowded out over time as eWpG issuances gain traction as “the gold standard” of security tokens. Furthermore, we do not expect this trend to be limited to the DACH region and predict that 2024 will see some issuers from other jurisdictions choosing to issue under the German framework. This will also be true for regulators and policy-makes across the globe who will follow the German regulatory “experiment” with ever-growing interest.

According to our predictive analysis, the leap to 2024 projects a noteworthy milestone in this trajectory, with an anticipated volume of 159 issuances, representing a compound annual growth rate (CAGR) of 223%.

In our forecasts, we delve into the segmentation of issuances by sector, shedding light on the diversity and burgeoning popularity of electronic securities among distinct types of issuers. A standout revelation is the prominence of SME Bonds, projected to retain its position as the most active sector, commanding a substantial 33% share of the total issuances in 2024. This would be a noteworthy uptick from a 22% share in 2023. This sector’s ability to sustain its market share while experiencing significant quantitative growth underscores its pivotal role as a driving force in the realm of electronic securities.

Beyond the confines of the eWpG the volume of tokenized assets will increase worldwide, driven by the demand for alternative investments and the emergence of new use cases and sectors. According to a report by 21.co, the market for tokenized assets could grow to be as large as $10 trillion in this decade as more and more traditional financial institutions continue to adopt blockchain technology. In 2024, the global tokenization market size is projected to reach $5.6 billion, expanding at a compound annual growth rate (CAGR) of 19.0% from 2021. Some of the industries that have already issued tokenized bonds include real estate, energy, infrastructure, and entertainment. We anticipate that more sectors will follow suit, such as art, gaming, sports, and intellectual property.

A recent shift in sentiment among legacy CSDs (Central Securities Depositories) towards embracing tokenization is one of the main reasons of our bullish stance. This move is exemplified by significant developments from EuroClear in the EU and DTCC in the US. EuroClear, a powerhouse for clearing and settlement of securities, has unveiled plans to introduce a platform for tokenized securities in 2024 in collaboration with Fnality, a blockchain consortium supported by several banks. Additionally, DTCC, the largest post-trade infrastructure provider in the US, has made strides by acquiring Securrency, a specialized blockchain firm focusing on tokenization and compliance. These strategic alliances and acquisitions underscore the relevance of the tokenized assets market beyond its current niche market share.

NYALA predicts that the standardization of tokenization will advance, as various initiatives and organizations work on developing common frameworks and protocols for the interoperability and regulation of tokenized assets. One of these initiatives is the ERC3643 Association, a non-profit organization that aims to promote the adoption of the ERC3643 standard, a set of guidelines and best practices for tokenizing securities on public blockchains, which recently passed the Ethereum community review and is now an officially accepted Token Standard (just like ERC20 or ERC721). Another parallel initiative is the Association of German Crypto Registrars which is working on creating its own less stringent standard for tokenized securities compliant with the eWpG and the associated Registerverordnung.

In other news, security token standards are also emerging outside of the crowded space of the public EVM chains: the Solana Token 2022 Standard is being newly developed by the Solana Foundation, a non-profit organization that supports the development of the Solana blockchain and hopes to incentivize issuances on Solana.

Tokenized assets are not to be confused with cryptocurrencies such as bitcoin. That said, the price of bitcoin (and other assets like ETH) will remain a key indicator for the industry’s health, as it reflects the overall sentiment and confidence in the underlying technology. Bitcoin, the first and largest cryptocurrency, has been on a bullish trend since late 2023. We expect it to reach new all-time highs above $68,000 in the first half of 2024. Some of the factors that have contributed to this rally include the hope for an interest rate cut by the US Federal Reserve, which could boost the demand for risk assets such as cryptocurrencies, the speculation about the approval of a Bitcoin ETF in the US, which could increase the institutional adoption of Bitcoin, and the new ESG narrative for proof-of-work (PoW) cryptocurrencies, which aims to address the environmental concerns by promoting carbon-neutral or carbon-negative Proof-of-Work mining practices.

In 2024 stablecoins and e-money tokens will start to play an indispensable role in the trading and settlement of tokenized securities, as they provide a reliable and efficient medium of exchange (or rather settlement) for on-chain trades and other types of transfers. Stablecoins are digital tokens that are pegged to a fiat currency or a basket of assets, while e-money tokens are digital tokens that represent a claim on a licensed issuer that commonly holds 100% reserves of the underlying asset, in this case EUR. There are multiple providers of competitive, multi-chain e-money tokens in the EU and in 2023 NYALA partnered with one of them, Monerium, for a smart bond POC on Polygon POS.

In this sector, the old saying “The institutions are coming” rings true in 2023: Société Générale has already made significant strides, pioneering the launch of its own stablecoin, EUR CoinVertible (EURCV), deployed on the Ethereum public blockchain. We expect others to follow in 2024.

The ECB recently launched a two-year investigation phase in July 2023, which will focus on the design, technical, and policy aspects of a digital euro. Based on ECB estimates the digital euro is unlikely to be available before 2027. With existing stablecoins and e-money tokens widely adopted and regulated under MiCa in 2024 it is, however, questionable whether there will be a need for a (wholesale) digital euro that is not already addressed by current (private) e-money providers and ones entering the space in 2024. We expect the industry to adopt regulated stablecoins as a de-facto standard long before the ECB catches up with the market in 2027.

In 2024 the tokenization landscape braces for a surge in electronic securities issuances under the eWpG, resulting in other countries starting to emulate the German approach by the end of the year. Simultaneously, the (RWA) tokenization market gears up for a solid multi-year growth period, driven by diverse industries embracing the technology due to newly found demand. The factor of institutional involvement, coupled with initiatives for standardization, hints at a significant shift in the overall sentiment. Delays in the digital euro’s launch raise questions about its future relevance amidst the rise of regulated stablecoins.