If you are reading this, you have likely heard about and possibly felt the portfolio impact of Terra USD losing its peg to the US dollar in recent days. Students of the history of financial markets will observe that price pegs are like promises: they are often broken. This is doubly true of algorithmic stablecoins, a relatively new type of cryptocurrency that has blown up spectacularly with each iteration attempted. If you are wondering what exactly happened over the weekend and what might happen next, Nyala has you covered.

First, let’s familiarize ourselves with what a USD stablecoin is: a cryptocurrency that aims to maintain a 1:1 price peg with the US dollar. USD stablecoins come in three main flavors: fiat-backed, crypto-backed, and algorithmic.

Fiat-backed USD stablecoins such as $USDT and $USDC remain the most popular of the three, as measured by their collective market capitalization. These are, ideally, 1:1 backed by and redeemable for fiat currency held on deposit with traditional financial institutions.

Crypto-backed USD stablecoins are, as the name implies, backed by other cryptocurrencies. These are almost always heavily over-collateralized, to protect the price peg with the US dollar when the value of the underlying collateral falls. $DAI is far and away the most popular crypto-backed USD stablecoin.

Algorithmic stablecoins are backed neither by fiat nor cryptocurrency; rather, an algorithm expands and contracts the outstanding token supply to maintain the US dollar price peg. Put simply, the algorithmic stablecoin supply contracts when the price is below peg and expands when it is above peg. These types of systems typically also rely on market participants acting on arbitrage opportunities that help maintain the peg, without central coordination. It is important to note that after many failed experiments involving the concept (Empty Set, Iron Finance, etc.), algorithmic stablecoin protocols increasingly use some amount of collateralization to bolster confidence in their ability to hold peg during market distress events.

This brings us to Terra, a blockchain protocol focused on issuing algorithmic stablecoins. Terra’s native token is $LUNA and Terra USD ($UST) commands by far the largest market capitalization of any stablecoin it issues. Without going into the detailed mechanics, $LUNA is burned and minted by the Terra protocol as needed to maintain $UST’s 1:1 peg with the US dollar. Due to a confluence of factors, $UST’s market capitalization exploded from roughly $180mn USD at the beginning of 2021 to a peak of more than $18bn USD before the crisis it suffered in recent days. This is a 100x increase in a little more than a year! The price and market capitalization of $LUNA grew at a similar clip, contributing significantly to the performance of Nyala’s N11 index as a constituent. The purpose of Nyala’s Core Index is to provide exposure to the seven largest non-stablecoin tokens by market capitalization, a criterion that $LUNA fit during its recent inclusion in the Core Index.

Credit: Coingecko.comArguably, the two most important factors driving this rapid growth were Anchor Protocol’s deposit rate and the active involvement of market makers. As the variable yields that could be earned on stablecoins in the most popular DeFi protocols compressed during 2021 and year-to-date, Anchor Protocol’s ~20% fixed yield on UST became attractive enough to attract more than $11bn USD worth of $UST deposits at its peak, a few days ago.

Credit:Defillama.comAt the same time, to meet the increased demand for $UST driven by Anchor Protocol’s fixed yield, market makers worked with Terra to increase the amount of $UST that could be minted each day. To protect against certain types of speculative attacks, Terra sets a ceiling on how much new $UST can be minted or burned in a given period of time. By working to increase the liquidity of $LUNA across many centralized and decentralized exchanges, these market makers enabled Terra to loosen their liquidity parameters and mint new $UST at a much faster rate without (so they surmised) significantly increasing the risk of $UST losing its peg or a reflexive collapse in the price of $LUNA during market turbulence. Furthermore, the Luna Foundation Guard (LFG), a consortium of market makers and investors, has been raising billions of dollars in additional capital to be used as collateral that can be liquidated to defend the $UST peg during market turbulence.

This gambit turned out to be successful, and Anchor Protocol became a behemoth of retained capital. However, such a high fixed yield on such a large sum of deposits is not sustainable and the protocol had to be repeatedly topped up by LFG with additional funds to keep paying it out. Furthermore, in recent weeks, other blockchain protocols began to mimic this model and threatened to siphon this capital away from Anchor Protocol. Both the NEAR and Tron protocols announced that they would launch a native stablecoin that could be minted with NEAR and TRX tokens and deposited in Anchor Protocol clones offering fixed yields as high as 30%.

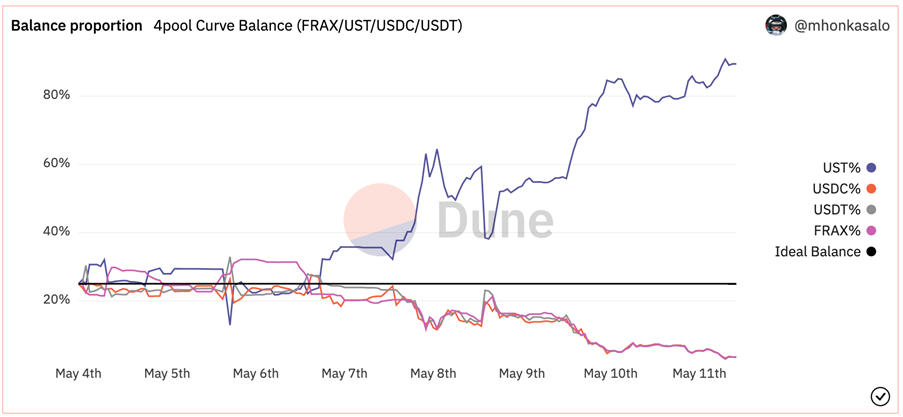

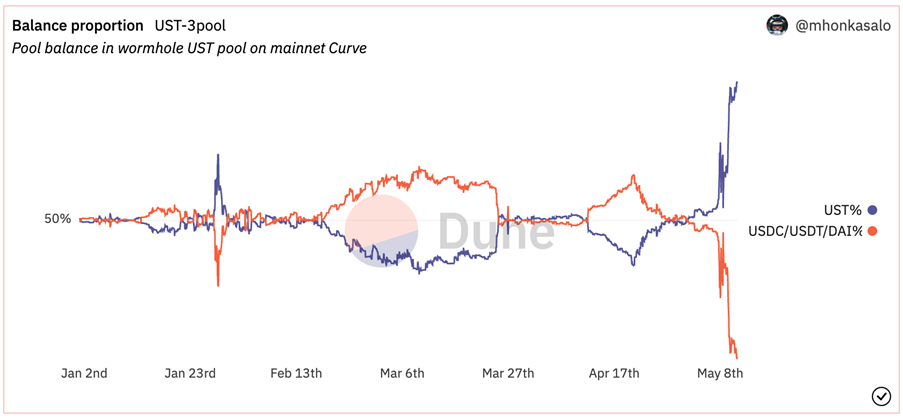

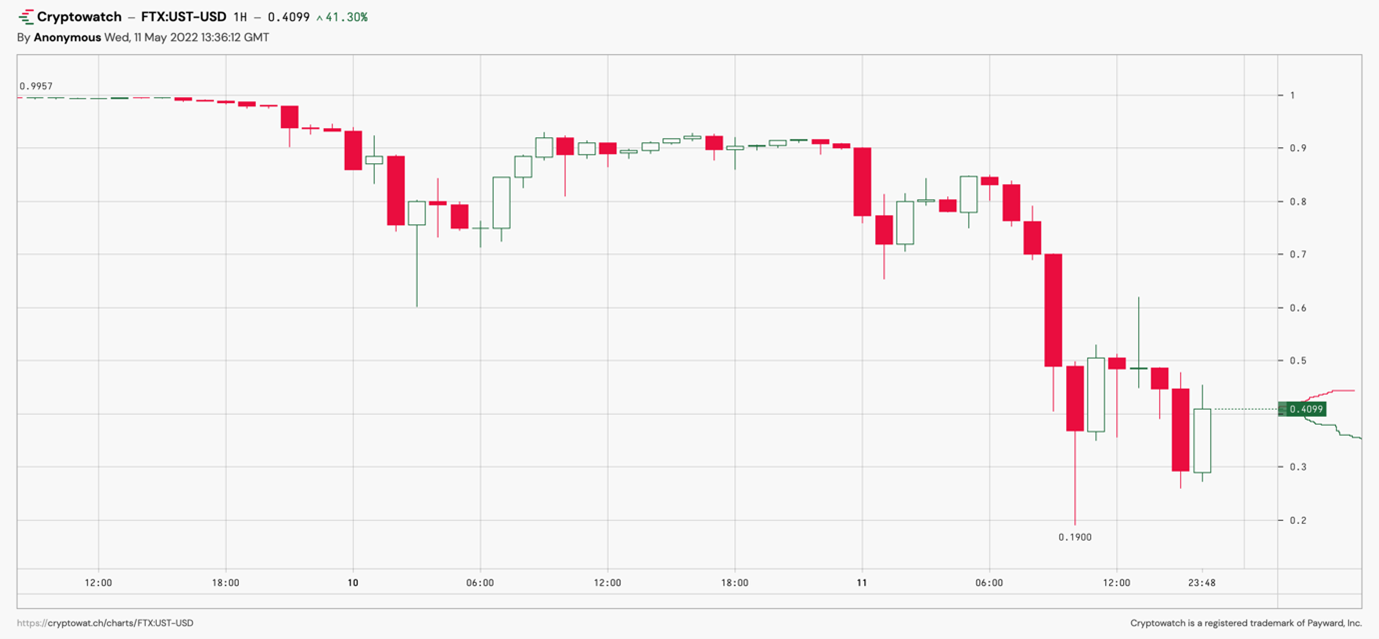

All of this exposition is required to understand the events of recent days. Over the weekend, an unknown party or parties began swapping hundreds of millions of $UST for other stablecoins held in Curve liquidity pools. The selling pressure was enough to throw the ratio of assets in the pool significantly out of balance, resulting in $UST trading further and further below the $1 peg. In response, members of LFG began liquidating hundreds of millions of $ETH and then $BTC in order to rebalance the liquidity pools and support the $UST peg on exchanges. Despite the monumental amount of capital burned to support the peg, the US dollar price of $UST sank to as low as $0.19 and still has not fully returned to $1.

Credit: Dune Analytics and @mhonkasaloCredit: Dune Analytics and @mhonkasaloCredit: Cryptowat.chRecent posts by Do Kwon, Terra’s public figurehead, indicate that UST will move to a collateralized model to restore confidence. It is also likely that Anchor Protocol’s deposit rate will need to be slashed significantly. Some action is already underway. At the time of publication of this article, a governance proposal to increase the rate at which UST can be burned in exchange for $LUNA is passing. This would significantly increase the inflation rate of $LUNA tokens and it appears that the market is frontrunning this measure passing by driving the price of $LUNA down even faster.

This appears to be an attempt to save the $UST peg at the expense of $LUNA price in the short term. However, because Terra relies on a Proof of Stake consensus mechanism, this would also decrease the cost and increase the probability of a chain re-organization attack that would render the network effectively unusable. Terra is currently between a rock and a hard place.

However, this is crypto and the outcomes are often surprising or absurd. Perhaps this final capitulation on the concept of fiat-pegged algorithmic stablecoins will reignite interest in mechanisms such as OlympusDAO, which has amassed an enormous treasury to experiment with different methods of bootstrapping an internet-native reserve currency that does not attempt to peg itself to a fiat currency. We will be watching the situation develop with great interest while continuing to avoid direct exposure to $UST and other algorithmic stablecoins for the foreseeable future.