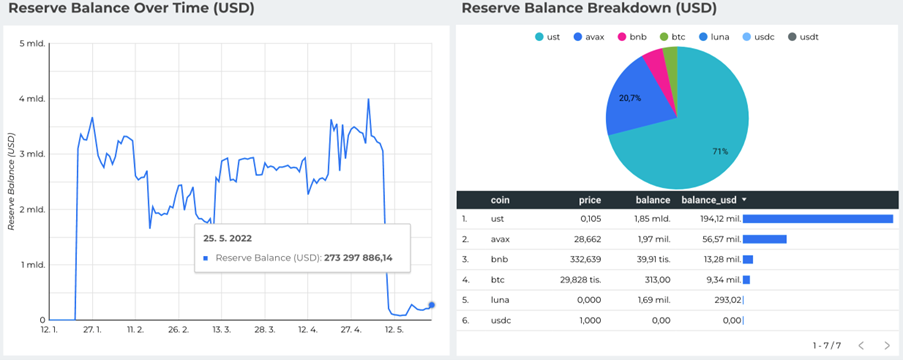

In the wake of the collapse of Terra, a debate is raging online over how best to engineer restitution for those left holding bags of $LUNA and $UST. Since our last article about Terra it has been revealed that the reserve fund to defend the $UST peg, previously worth billions of dollars, has been nearly entirely liquidated and will cover only a small fraction of total losses if repurposed as a recovery fund.

Rather than accept that the losses are largely irrevocable, the crowd focuses on engineering ways to recoup them via the means available: burning tokens and creating a new chain. Seasoned participants knows that these tactics are easy to sell when real solutions are unavailable but usually end in disappointment.

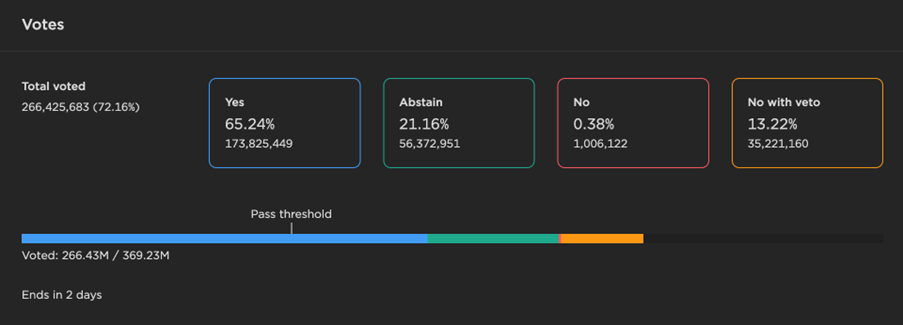

Coordinated burning of $LUNA and $UST is generally opposed by those with large balances, as they would need to sacrifice disproportionately for the plan to have any impact. They are more likely to vote “Yes” for Proposal 1623, put forward by Do Kwon, Terra’s besmirched figurehead. The proposal involves spinning off Terra as a new blockchain without native support for algorithmic stablecoins. The old chain and its token will be deprecated to “Terra Classic” and $LUNC; the new chain and token will take the flagship names “Terra” and $LUNA.

The total supply of this new token will be airdropped in the following proportions (after excluding the balance of Terraform Labs’ address):

A little bit more than 10% of the new token’s total supply will be transferable at mainnet launch and there will be a six month cliff before any further significant token unlocks occur. Proposal 1623 looks very likely to pass on May 25th at ~11:00 UTC, with nearly half of all eligible voting power already accrued to ‘Yes’.

The elephant in the room with this plan is that minting UST and depositing it in Anchor Protocol for ~20% fixed APR created the overwhelming majority of the demand for $LUNA previously. If the new $LUNA is devoid of this utility, it is reasonable to expect that its initial recipients will race each other to sell their allocation first.

Another crucial factor in the success of the new chain will be how much support from centralized exchanges there will be in the form of distributing the new token to their clients and listing it for trading. This support does not look to be secured yet, seeing that the major exchanges which have $LUNA and/or $UST listed have been either silent or publicly disapproving of proposal 1623. Centralized exchanges can be expected to generally prefer plans that involve burning existing $LUNA, as it carries much less risk and expense for them than supporting a new blockchain for funding and trading.

In the end, the likeliest outcome is that there will be both a new chain with insufficient utility to gain real traction and a coordinated token burn on the old chain insufficient to adequately pump the price of the old token or revive the $UST peg and nobody will be fully satisfied. We hope that some miracle solution arises which allows everyone to recoup a significant amount of their losses, but prior experience leads us to emphasize the importance of prudent thinking in these scenarios.

NYALA recommended to clients and partners, specifically its subsidiary Wevest AG, to abstain from voting in proposal 1623 because the viability of the forked chain is uncertain. However, in the event of the fork going forward, NYALA will monitor the stability of the new chain before making any further recommendations to partners and clients. In any event, there will be a “Post-attack” snapshot to be taken at Terra Classic block 7790000 (roughly 20:00 UTC on May 26th, 2022). The new Terra blockchain is planned to be launched a few hours after this snapshot.